The Renewal of the ageing short sea fleet: a huge opportunity for Northern Dutch Shipbuilding

As clearly described by editor-in-chief Antoon Oosting in his opinion piece Markets in SWZ|Maritime’s July-August issue of this year, the renewal of the short sea shipping fleet finally takes off. Despite a lot of orders ending up in Asia, Conoship International’s managing director Jan Jaap Nieuwenhuis also sees a huge opportunity for Northern Dutch shipbuilding.

It is true that many of the orders to build this new generation of sophisticated and innovative vessels land with Asian shipyards, which does give a risk of undesired knowledge transfer and losing another market segment to Asian shipyards. However, the huge renewal demand also provides the opportunity for Dutch, and other Western European shipyards, to re-capture a part of the market and to broaden their market share.

At the moment, we are far from utilising the maximum capacity of the (northern) Dutch and German shipyards. A number of the Northern Dutch shipyards, like Ferus Smit, Royal Bodewes and Thecla Bodewes do, however, regularly show that it is possible to fill their building capacity with short sea cargo vessels in a competitive way in North Western Europe. Building these ships provides significant advantages, but also requires that a number of conditions are met.

As Rick Brinkman, senior naval architect at Ferus Smit Shipyards states in his interview with Schuttevaer: ‘Building in Europe is back in the interest of shipping companies. This is due to higher delivery reliability and the elimination of various risks. We really notice that more requests are coming in as a result. It doesn’t help that banks, in general, are increasingly categorising shipbuilding as “risky”.’

A large part of the latent capacity of Dutch yards is formed by relatively small shipyards, which are now involved in section building or the production of small workboats. These shipyards frequently struggle to provide the required refund guarantees to build vessels for cargo vessel owners, who are backed by banks and finance houses. New ways of providing the security of a refund guarantee can be developed, and are under discussion. This will, however, require support from national and local governments.

The maritime industry in the Northern Netherlands is innovative and strong and of great importance for the economy. In the coming years, this industry will make the transition to sustainable shipping. I am pleased that this challenge is being taken up in a unique collaboration between business and knowledge institutions. The maritime industry is truly Dutch Glory, which we can prepare for the future by developing, securing, and expanding the innovative ecosystem

Henk Emmens, Deputy of the Province of Groningen

Competing on price with Asian yards is difficult, but not impossible. Numerous research projects have shown that a price reduction of about 1 EUR/kg would be sufficient to reduce the cost price to competitive levels when comparing the complete project costs, including building supervision, site teams, transport costs from Asia to Europe, insurance, etc.

The maritime sector itself has already taken the lead to come to these required efficiency improvements and price reductions, by starting numerous projects in which they investigate new ways of cooperation, a further digitalisation of the shipbuilding processes and the introduction of robots and other automation.

Robotisation and digital shipbuilding

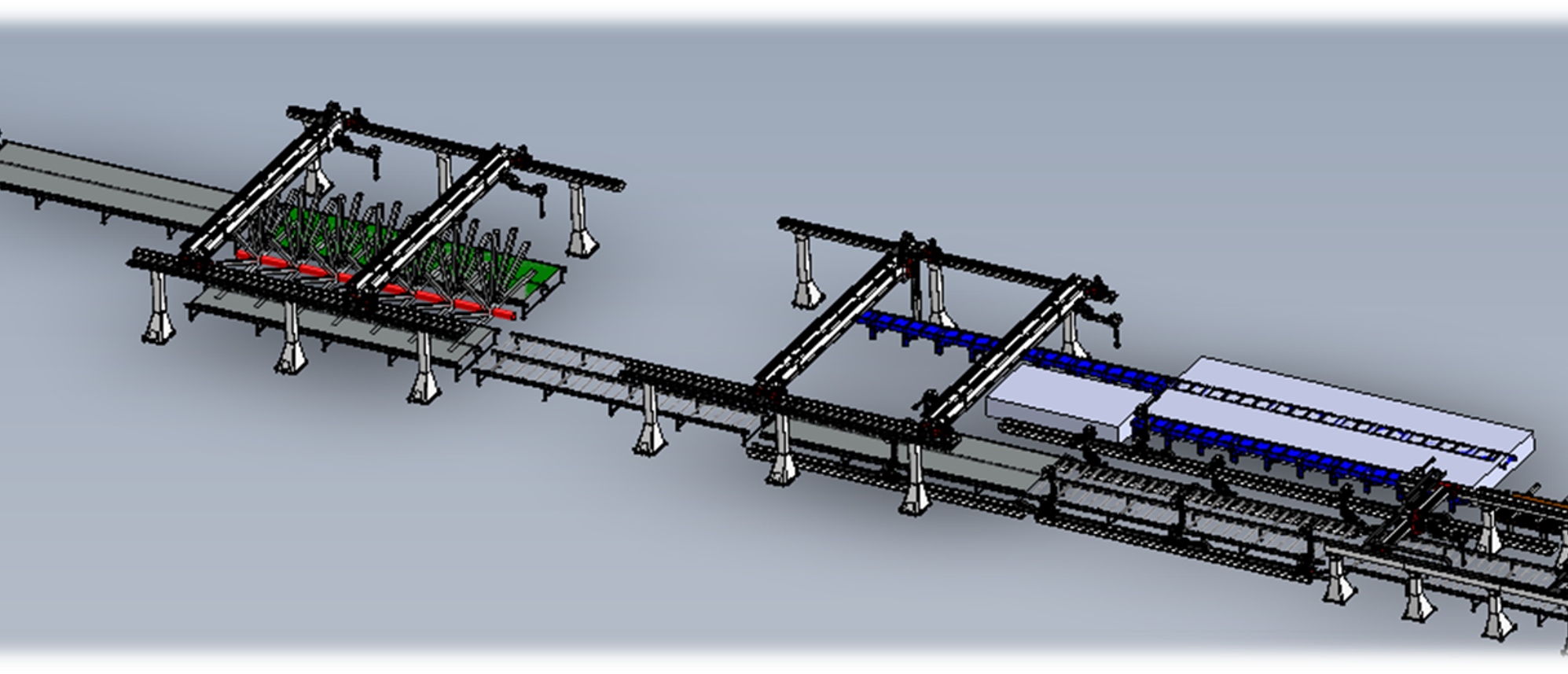

Several partners in the Northern Netherlands have investigated the feasibility of the development of a robotised micro panel factory with and by the Northern Netherlands shipyards, for centralised digitised production of steel panels and sub-sections for the shipyards. This investigation revealed that twenty to thirty per cent of the weld length of a ship’s section can be found in micro panels, which can be welded automatically.

A robotised micro panel factory is to reduce the cost of producing steel panels.

The digital shipbuilding process is developed in the project FieldLab Digital Shipbuilding 4.0, where digitalisation and robotisation of welding- and assembly processes at the shipyards are investigated, tested, and trained. Digital support for the cooperation and coordination of co-makers and shipyards will make the outfitting and installation of engine room and electrical systems in ships much more efficient.

Pooling knowledge

Furthermore, the process of decarbonising the shipping industry has only just started. Many more steps will come, which partly will require new technologies, such as shipboard carbon capture plants, large scale wind propulsion or a further electrification of ships. Several of these technologies are currently under development with companies within Western Europe. An early cooperation and integration between these technology developers and shipyards could give the European shipbuilding industry a head start and produce the ships that incorporate these technologies more competitively than Asian shipyards. Yet, this does require openness and a will to cooperate and innovate.

With projects such as the Green & Digital Maritime Innovation Ecosystem North-Netherlands (GDMIEN-NL), the maritime sector in this part of the Netherlands is pooling its knowledge and expertise to realise the technologies needed for green shipping. In this project, 21 technology developers together create the innovation ecosystem from which new cooperation structures are developed around at least four innovative technologies for the transition from fossil to renewable energy:

- Fully electric propulsion on renewable Redox Flow battery technology;

- 30-metre VentoFoils XL, wind propulsion units for ships;

- Sailing on hydrogen (H2) by “marinising” fuel cells of 500-3000 kW;

- Ship-based carbon capture and liquefaction installations.

Ingredients needed to build in Europe are there

The advantages of building in NW Europe, such as good building quality, high delivery reliability, easy building supervision, higher second-hand value, protection of knowledge, etc. are clear to most owners. With the right price and conditions, many of them do not need a lot of persuasion to build in Europe. The ingredients to meet these conditions are there, under development, and in many cases already very close by.

We believe that with swift and further support and an intensification of these initiatives, we can still prevent losing short sea shipbuilding to Asia. But the time for action is now.

With a production value of more than EUR 3.5 billion, the Northern Netherlands is one of the leading maritime regions in the Netherlands. With innovations in the maritime ecosystem, we will maintain and, where necessary, strengthen our position in global shipbuilding and shipping.

Egbert Vuursteen, CEO of Royal Wagenborg and chairman at the Groninger Maritime Board.