The strategic interests of the Dutch Maritime Manufacturing Industry

Conoship’s recent New Year’s Reception reflected on ‘The strategic interests of the Dutch Maritime Manufacturing Industry’. Speaker Frank Bekkers, Programme Director of The Hague Centre for Strategic Studies (HCSS), reflected on the contemporary geopolitical landscape and the opportunities and threats facing the Dutch maritime manufacturing industry.

HCSS conducts research on geopolitical, defense & security issues and is a strategy advisor to governments, international institutions, and businesses. Commissioned by the Ministry of Economic Affairs and Climate, HCSS has recently looked at the strategic interests of the maritime manufacturing industry. The resulting report De Strategische Belangen van de Nederlandse Maritieme Maakindustrie provided a solid foundation for the Sectoragenda Maritieme Maakindustrie by linking possible governmental measures in support of the sector to the vital interests of the Netherlands.

In his presentation, Frank Bekkers looked at three major geopolitical trends that may shape the maritime sector in the coming decade.

The influence of great power competition and bloc formation on maritime trade patterns

We currently witness growing tensions between major powers in the international arena. This will influence global trade. In particular, the economic and technological competition between China and the US translates into growing protectionism worldwide. In the wake of China and the US, and accelerated by Russia’s invasion of Ukraine, the EU is looking for ways to reduce dependences on geopolitical rivals like China and Russia and ‘de-risk’ global supply chains. Amongst others, this is done by reshoring production and diversion of supply chains – preferably to partners and closer to home.

Furthermore, the cost of transport is rising. This extends beyond fuel costs. Consider costs of fees and environmental costs. The skewed market of supply and demand for containers also leads to rising costs; as do the congestion of the Panama Canal and accidents like the blocking of the Suez Canal by the Ever Given.

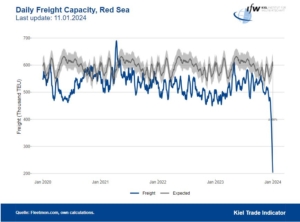

But possibly the biggest cost driver is exemplified by the recent ship attacks in the Red Sea. Covering security risks is becoming increasingly expensive and, in some cases, prohibitively. One of the main underlying developments is that local, intrastate conflicts – such as in Yemen – internationalise. The current attacks by the Houthi rebels in the Red Sea, one of the warring Yemenite factions, are the result of this dynamic.

Figure 1: The amount of cargo carried across the Red Sea in mid-January 2024 is almost 70 per cent below normal.

Source: the Kiel Institute for the World Economy.

Another concern for international maritime trade is that China could restrict – and has already forcefully restricted – freedom of navigation through excessive territorial claims around artificially created islands in the East and South China Sea. In 2013, the Philippines initiated legal proceedings against China about this. In 2016, the Permanent Court of Arbitration in The Hague ruled that China’s historic claims to the South China Sea were invalid. However, China openly rejected this statement and continued to expand and militarize areas in the South China Sea.

Figure 2: China restricts freedom of navigation by creating artificial islands to back territorial claims in the South China Sea

Source: Asia Maritime Transparency Initiative

A maritime counterpart to the scramble for resources!?

The worldwide competition for raw materials is increasing. This has for instance led to the scramble for resources between major economic players in Africa. In the next decade the search for new sources of raw materials is likely to extend to the deep seas.

Deep-sea mining is a potentially new industry that does not exist yet. Although exploratory drilling is currently taking place, commercial deep-sea mining is not yet permitted under international law. However, the International Seabed Authority (ISA) has awarded 31 ‘exploration agreements’. Norway recently announced extensive plans for research.

But deep sea mining is not a run race. Opponents have three main arguments:

- It is expensive and unnecessary;

- It may cause possible major environmental damage;

- It may trigger additional international tensions if a scramble for deep-sea resources emerges.

Even so, it is likely that deep-sea mining in some form will take off in the coming decade. It fits with Europe’s and other states and blocs to reduce dependencies on systemic rivals on the world stage.

Figure 3: Article Dutch news agency NOS about Deep-sea mining

Figure 4: Source De Volkskrant

Climate change and maritime sustainability

The climate crisis affects us all. To keep the global temperature rise within acceptable limits, the world must drastically reduce the use of fossil fuels. The main result of the recent UN Climate Change Conference (COP28) is the adaptation of a roadmap for ‘transitioning away from fossil fuels’. Shipping must also become more sustainable.

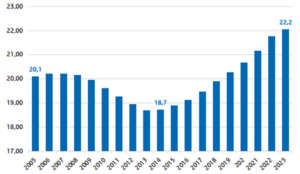

In combination with an ageing fleet, this will generate a high demand for retrofitting existing ships or building new ships based on ‘net zero’-technologies. Half of the fleet is older than 20 years. This may also cause the market for retrofit to be relatively limited because, for many older vessels, it is either impossible or too costly to adapt to new emission norms and standards. The replacement demand for short-sea shipping is also huge.

Figure 5: the average age of the global commercial fleet.

Source: UNCTAD Review of Maritime Transport 2023

Also read: THE RENEWAL OF THE AGEING SHORT SEA FLEET: A HUGE OPPORTUNITY FOR NORTHERN DUTCH SHIPBUILDING

Climate mitigation has also triggered the energy transition. For the North Sea countries, electricity will increasingly come from offshore wind parks. In the next two decades, thousands of wind turbines will be constructed in the Dutch part of the North Sea alone. So, slowly replacing huge oil tankers navigating the global waterways, we will see a surge of small and large utility vessels for the construction and maintenance of offshore wind parks close to densely populated coastal areas.

Dutch perspective

After his trip around the world, Frank Bekkers returned closer to home to round off his talk with a Dutch perspective. These three geopolitical trends will affect global trade patterns and the Dutch maritime manufacturing industry. Remarkably, the maritime manufacturing industry is the first sector for which the government has elaborated its industry policy. The most important challenges stemming from the sector agenda lie within the institutes and companies in the industry itself. Major trends and developments in the emerging world often offer new possibilities. In a panel discussion after Frank Bekkers’ presentation, we further explored the vast potential for the maritime sector.

The next article will reveal the opportunities and threats the maritime industry foresee itself.

Conoship’s extensive experience, comprehensive design library, and highly qualified staff enable the company to develop customised consultancy work that meets the specific needs of each client. Our consultants regularly advise various institutions and policymakers, such as governments, port authorities, and member organisations on the consequences of new rules and regulations. We also help our clients to support decisions on future designs, operational inefficiencies, and investments.

Curious or need some maritime expertise? Contact us to discuss what we can realise together!